Introduction

In today’s fast-paced world, having a robust health insurance plan is more than just a necessity; it’s a safety net that protects you and your family from unforeseen medical expenses. Whether you’re an individual, a parent, or nearing retirement, understanding the intricacies of health insurance can help you make informed decisions and secure peace of mind.

What is Health Insurance?

Health insurance is a contractual agreement between you and an insurance provider. It ensures coverage for medical expenses incurred due to illnesses, injuries, or other health-related conditions. Depending on the plan, this could include hospitalization, doctor visits, prescription medications, and preventive care.

Why Health Insurance is Essential

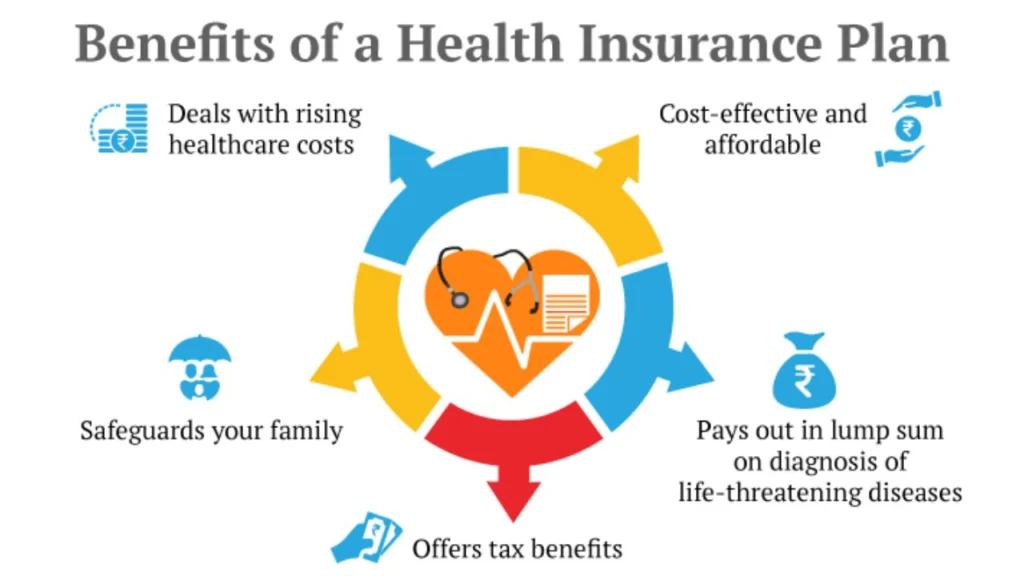

Financial Security: Health insurance mitigates the burden of high medical costs, especially during emergencies.

Access to Quality Healthcare: Insurance plans often provide access to a network of reputable healthcare providers.

Preventive Care: Many policies cover regular check-ups, screenings, and vaccinations, promoting overall well-being.

Tax Benefits: In many countries, premiums paid for health insurance are eligible for tax deductions.

Types of Health Insurance Plans

Understanding the types of plans available can help you choose one that best suits your needs:

- Individual Health Insurance

Designed for single individuals, covering hospitalization, outpatient treatments, and sometimes preventive care.

- Family Health Insurance

Provides coverage for the entire family under a single plan, making it cost-effective and convenient.

- Group Health Insurance

Offered by employers, group plans are beneficial for employees and often extend coverage to their families.

- Critical Illness Insurance

A specialized plan covering life-threatening diseases like cancer, heart attacks, and strokes.

- Senior Citizen Health Insurance

Tailored for individuals aged 60 and above, focusing on age-related health issues.

How to Choose the Right Health Insurance Plan

Choosing the right health insurance plan can be overwhelming. Here’s a step-by-step guide to help you:

Assess Your Needs

Consider your age, family size, medical history, and lifestyle.

Compare Plans

Use online tools to compare premium costs, coverage, and additional benefits.

Check the Network Hospitals

Ensure the insurance provider has tie-ups with reputed hospitals in your area.

Read the Fine Print

Understand the terms, conditions, exclusions, and claim process.

Consider Premium and Coverage Balance

Opt for a plan that offers comprehensive coverage without straining your budget.

Tips to Maximize Your Health Insurance Benefits

Opt for Preventive Care: Utilize free health check-ups and screenings offered by your plan.

Understand the Claim Process: Familiarize yourself with cashless and reimbursement claim procedures.

Renew Policies on Time: Avoid policy lapses to maintain continuous coverage.

Increase Coverage as Needed: Upgrade your plan as your family grows or health needs change.

Common Myths About Health Insurance

Young People Don’t Need Insurance: Health emergencies can occur at any age.

All Expenses Are Covered: Read the exclusions in your policy to avoid surprises.

Health Insurance Is Expensive: Affordable plans are available; it’s about finding the right fit.

Conclusion

Health insurance is a critical investment in your future. It not only provides financial protection but also ensures timely access to quality healthcare. By understanding your needs and comparing options, you can choose a plan that offers the best value for money. Don’t wait for a medical emergency to realize its importance—secure your health and peace of mind today.