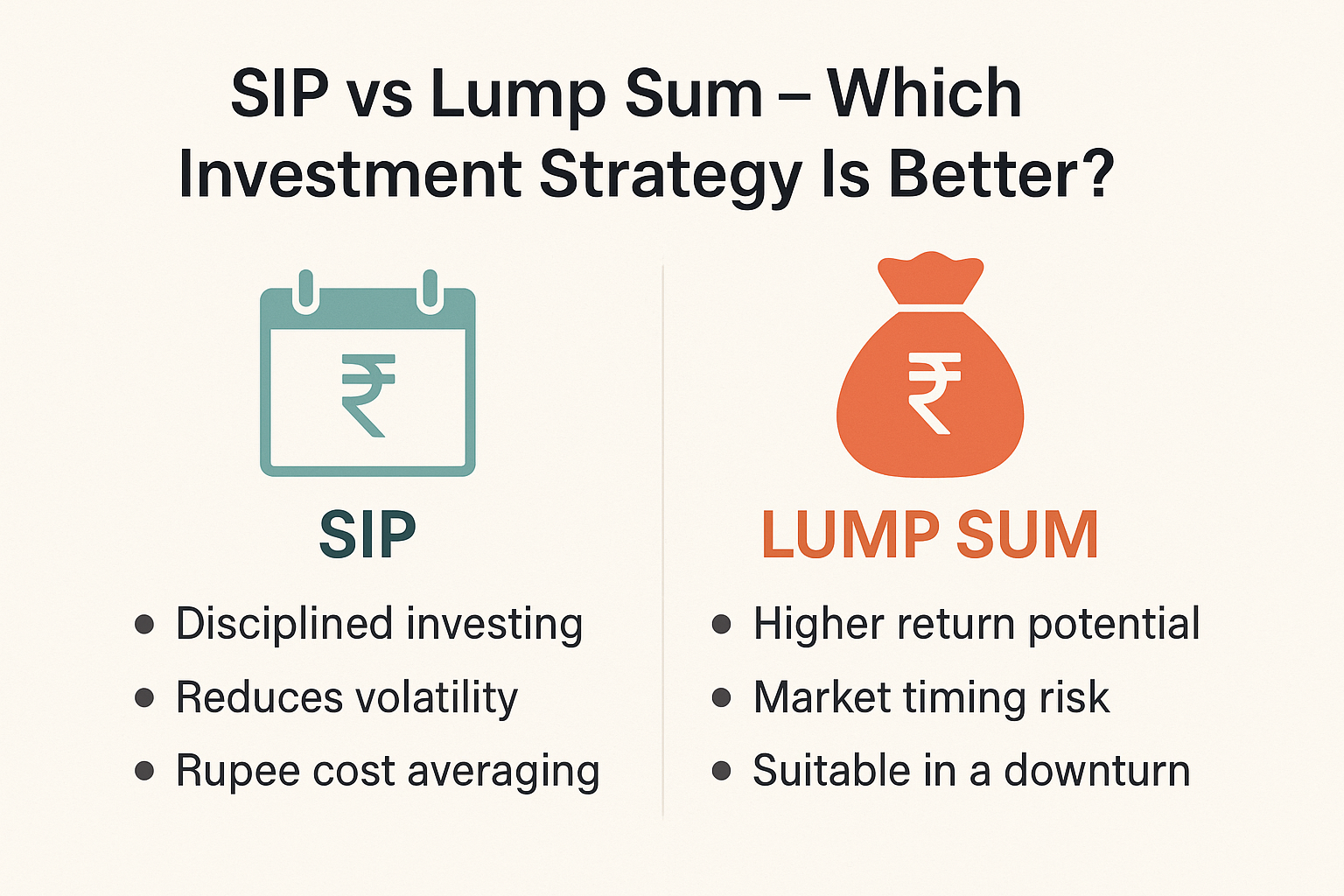

When it comes to investing in mutual funds or the stock market, one of the most common questions investors face is whether to opt for a Systematic Investment Plan (SIP) or go with a Lump Sum investment. Both SIP vs Lump Sum strategies offer unique advantages, and the better option depends largely on your financial goals, risk tolerance, and market conditions. Let’s explore both approaches in detail and see which one might suit you better.

Understanding SIP

A Systematic Investment Plan (SIP) is a method where you invest a fixed amount at regular intervals—typically monthly—into a mutual fund. This approach is ideal for individuals with a regular income, such as salaried employees.

SIPs offer several key benefits. First and foremost, they promote disciplined investing. You don’t have to worry about timing the market because your investments are spread out over time. This helps reduce the risk of market volatility. Another advantage is rupee cost averaging, which means you buy more units when the price is low and fewer when the price is high, bringing down your average cost per unit over time.

Additionally, SIPs are highly flexible. You can start with as little as ₹500 per month, and most fund houses allow you to increase, pause, or stop your SIPs at any time.

Understanding Lump Sum Investment

In a Lump Sum investment, you invest a large amount of money all at once. This method is usually preferred when you have access to a significant corpus, such as a bonus, inheritance, or proceeds from the sale of an asset.

Lump Sum investing has the potential for higher returns, especially in a bull market when the market is rising. Since the entire amount is invested at one go, your money gets the benefit of compounding from day one. However, the biggest risk with Lump Sum investing is market timing. If you invest just before a market correction or downturn, your entire portfolio may take a hit.

This approach is best suited for individuals who are market-savvy, have a higher risk tolerance, and can withstand short-term volatility.

Which Strategy Works Better?

The answer depends on several factors. SIP is generally a better option for new investors or those who do not want to take the risk of timing the market. It helps you stay invested consistently over time, which is especially helpful in a volatile or unpredictable market environment. SIPs also help in building the habit of saving and investing regularly.

On the other hand, Lump Sum investment can work well if you’re confident about market trends and have a long-term outlook. If markets are down or going through a correction phase, a Lump Sum investment can give you a great entry point and maximize returns as the market recovers.

In terms of emotional comfort, SIP wins. It reduces anxiety related to market fluctuations and keeps you from making impulsive decisions based on short-term movements. It’s easier for most people to stay the course with a small monthly investment than to risk a large amount all at once.

A Balanced Approach

Interestingly, many financial advisors recommend a combination of both strategies. For instance, if you receive a large sum of money—say ₹10 lakh—you could invest ₹2 lakh upfront as a Lump Sum and distribute the remaining ₹8 lakh through SIPs over the next 12 months. This approach gives you partial exposure to immediate growth while still managing risk through staggered investments.

Conclusion

There is no universally correct answer when choosing between SIP vs Lump Sum. It all boils down to your financial goals, available funds, and risk appetite. SIP is ideal for those who want to build wealth gradually and safely over time, while Lump Sum investments can yield greater returns when timed well.

Rather than stressing over which method is better, focus on starting early, staying consistent, and investing according to your plan. After all, in the world of investing, time in the market often beats timing the market.

Our Telegram Community is : https://t.me/+J-Cy6eE501g1NDVl

Our Recorded course is available :https://dodgerblue-hyena-760930.hostingersite.com/product/stock-market-essentials-from-basic-to-advanced-strategies/