When it comes to financial planning, choosing the right investment vehicle is crucial. Two popular options for conservative and growth-focused investors are Post Office Saving Schemes (POSS) and Systematic Withdrawal Plans (SWP) in Mutual Funds. While both offer steady returns and financial security, they cater to different financial goals. Let’s compare these two investment options to help you make an informed decision.

What is a Post Office Saving Scheme (POSS)?

The Post Office Saving Scheme is a government-backed investment option that provides guaranteed returns with minimal risk. These schemes are ideal for conservative investors who prioritize safety and stable income over high returns.

Features of POSS:

- Fixed interest rates: Backed by the government, the interest rates are revised quarterly.

- Variety of schemes: Includes options like the Public Provident Fund (PPF), National Savings Certificate (NSC), Senior Citizens Savings Scheme (SCSS), and Monthly Income Scheme (MIS).

- Tax benefits: Some schemes offer tax deductions under Section 80C of the Income Tax Act.

- Low risk: As a government-backed scheme, there is no risk of capital loss.

What is a Systematic Withdrawal Plan (SWP) in Mutual Funds?

A Systematic Withdrawal Plan (SWP) is a feature offered by mutual funds that allows investors to withdraw a fixed amount at regular intervals. It is a smart way to generate passive income while keeping the remaining funds invested.

Features of SWP:

- Customizable withdrawals: Investors can choose the amount and frequency of withdrawals.

- Market-linked returns: The remaining capital continues to grow based on mutual fund performance.

- Tax-efficient: Long-term capital gains (LTCG) in equity funds are taxed at 10% beyond Rs. 1 lakh, whereas debt funds follow indexation benefits.

- Flexibility: Unlike fixed deposits or POSS, there are no fixed lock-in periods, allowing partial withdrawals without breaking the entire investment.

Key Differences Between POSS and SWP

| Feature | Post Office Saving Scheme | SWP in Mutual Funds |

|---|---|---|

| Risk | Low (Government-backed) | Medium to High (Market-linked) |

| Returns | Fixed (5% – 8% annually) | Variable (Market-dependent) but approximately 10%- 15% |

| Liquidity | Limited (Lock-in periods for some schemes) | High (Withdrawals as per choice) |

| Tax Benefits | Available for PPF, NSC, SCSS (Section 80C) | Tax-efficient withdrawals |

| Investment Horizon | Long-term | Short to long-term (flexible) |

| Ideal For | Retirees, risk-averse investors | Investors looking for periodic income with growth potential |

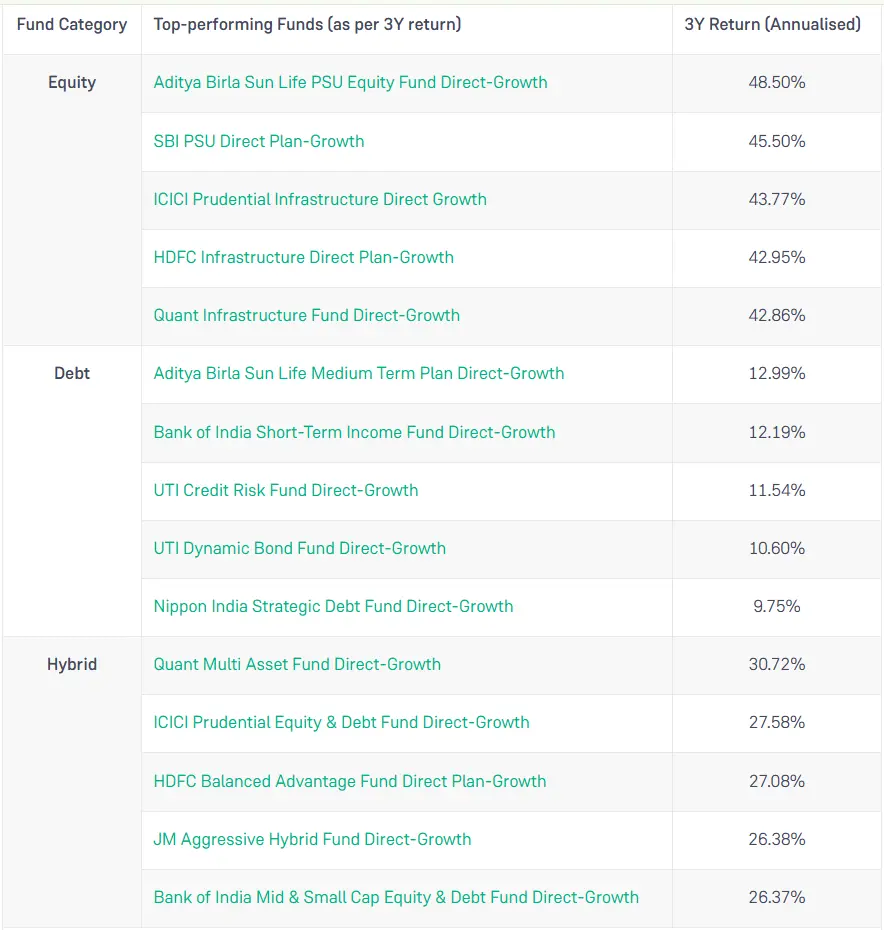

The Funds Which preformed Best In 2024

Which One Should You Choose?

- Choose POSS if:

- You seek safe and guaranteed returns.

- You prefer fixed interest and low risk investments.

- You are looking for tax-saving options like PPF and NSC.

- Choose SWP if:

- You want higher returns and are comfortable with some market risk.

- You need regular income while keeping your capital growing.

- You prefer flexibility in withdrawals.

Conclusion

Both Post Office Saving Schemes and SWP in Mutual Funds have their advantages and serve different financial goals. If you are looking for stable, risk-free returns, POSS is a great choice. However, if you want to enjoy higher returns and liquidity, SWP in mutual funds is a better option. Assess your financial needs, risk appetite, and long-term goals before making a decision.

FAQs

1. Can I lose money in SWP mutual funds?

Since SWP is market-linked, there is a chance of capital erosion in a declining market. Choosing a well-performing fund reduces this risk.

2. Is the interest in Post Office Saving Schemes taxable?

Yes, except for PPF, the interest earned on POSS is taxable.

3. Can I start an SWP in any mutual fund?

Yes, most mutual funds offer an SWP option, but it’s best suited for debt or balanced funds to minimize risk.

For a well-balanced portfolio, a mix of both options can provide financial stability and growth.

For more Details contact us. https://waystogrowth.com/contact/